Investing isn't a sprint;

It’s a

"Marathon"

Investing isn't a sprint;

It’s a

"Marathon"

your financial goals.

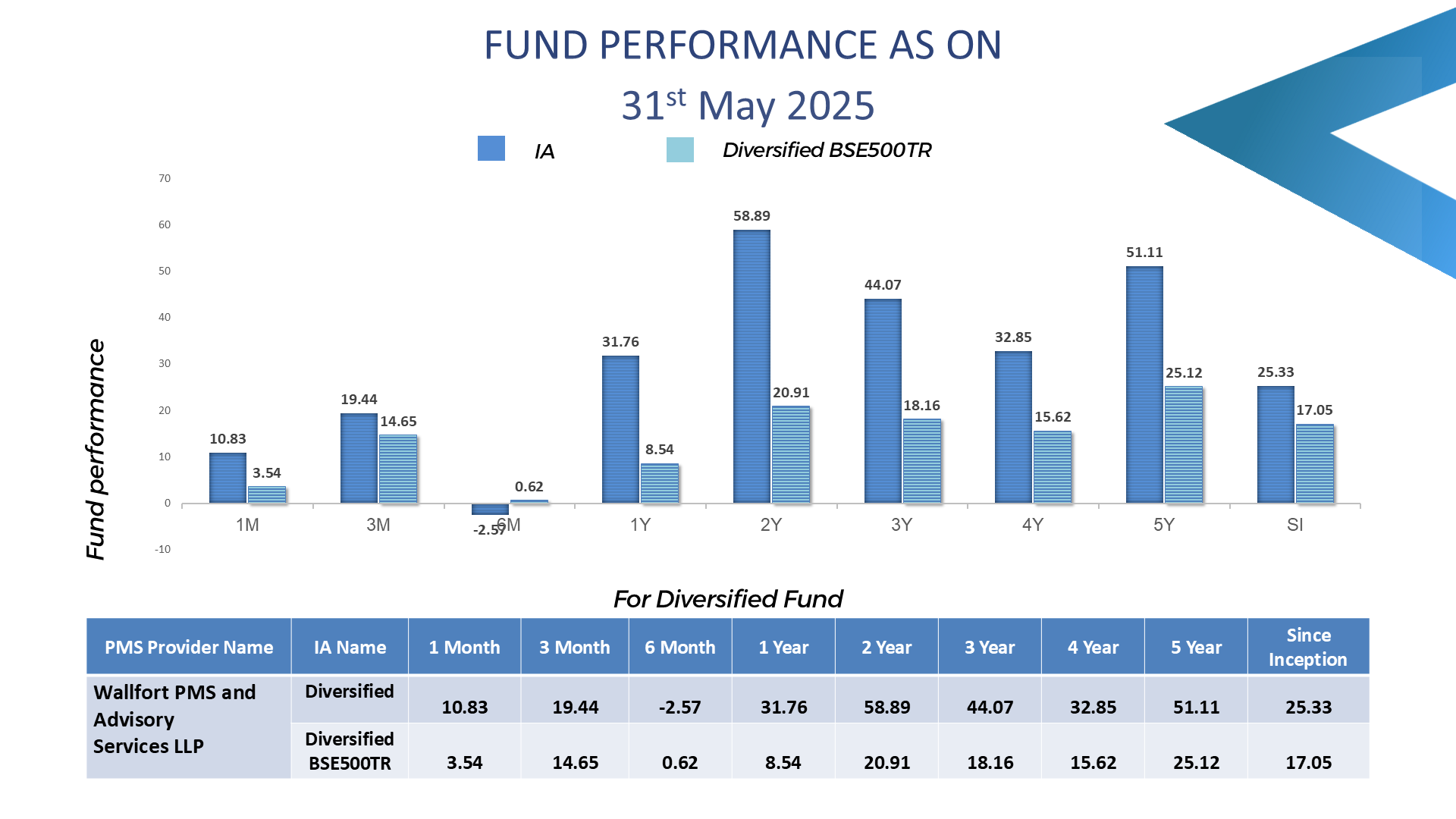

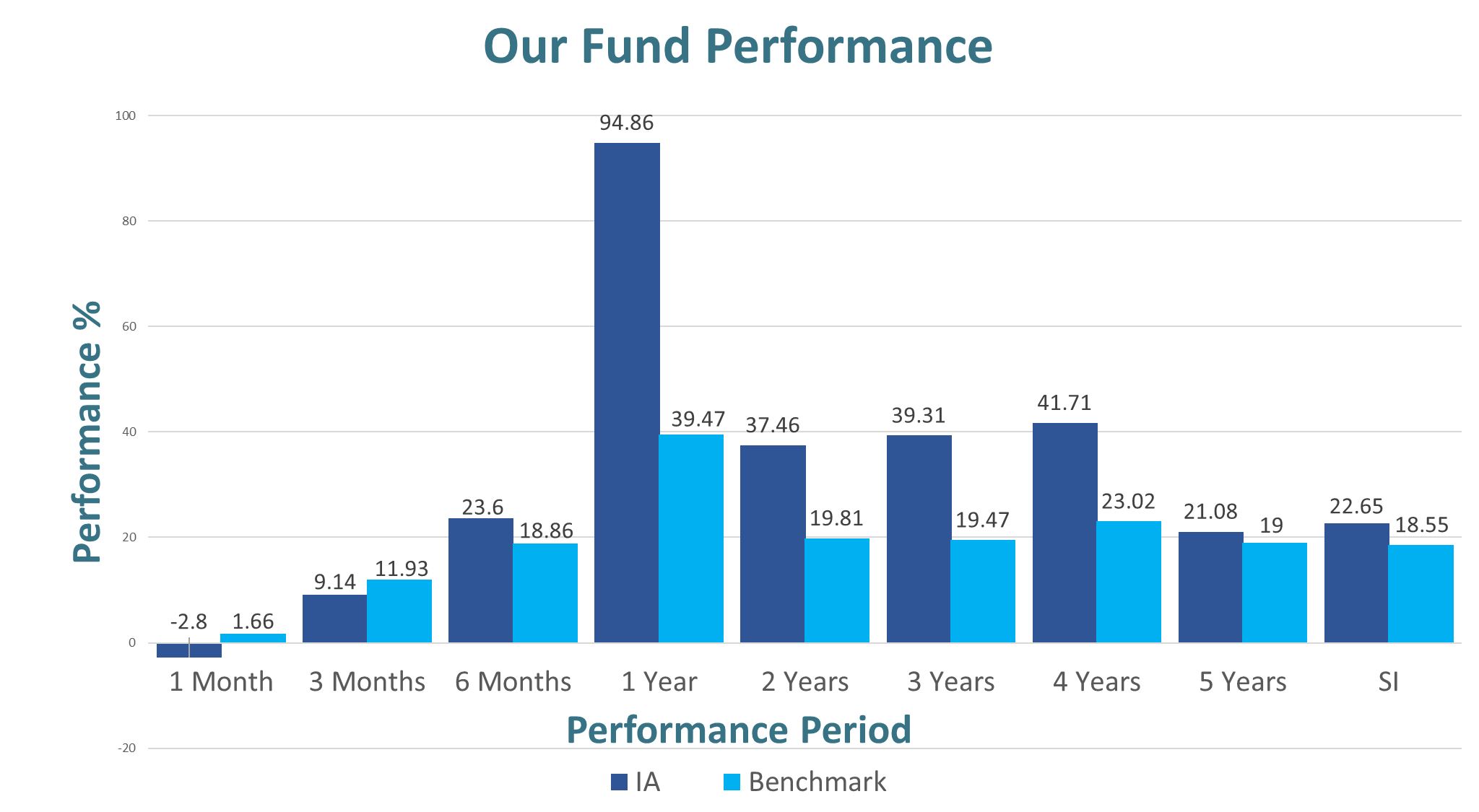

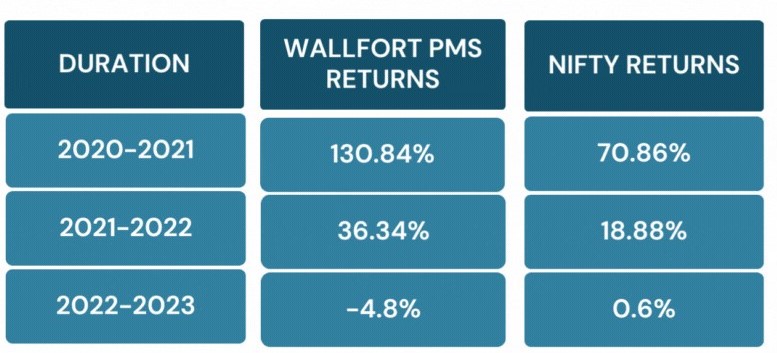

Our Fund Performance

Investing isn't a sprint;

It’s a

"Marathon"

Investing isn't a sprint;

It’s a

"Marathon"

your financial goals.

- About Us

Navigating Prosperity,

Investing with Purpose.

Welcome to Wallfort PMS – Your Partner in Navigating Prosperity and Investing with Purpose.

Founded by Mr. Vijay Bharadia, Wallfort PMS is a SEBI registered (No INP000006192) Portfolio Management and Investment Advisory firm based in Mumbai, India.

Catering to both offshore and domestic investors, our firm specializes in making conservative and responsible non-speculative investments. At Wallfort PMS, we prioritize financial security and peace of mind for our clients, ensuring that their investments are aligned with their long-term goals.

Join us at Wallfort PMS, and let’s embark on a journey towards building a prosperous future together.

Vision

Empowering Investors, Shaping Futures. Our vision is to set the standard as the premier Portfolio Manager in the equity segments of Small & Mid Caps.

Mission

Our mission is to spread the transformative power of compounding, empowering every individual to achieve their financial goals.

- FEATURES & COMPARISON

FEATURES AND COMPARISONS OF ASSET CLASSES OVER LAST 20 YEARS 2004 TO 2024

- Best liquidity

- Easy partial exits

- Spread risk

- Lower taxes

- Low Liquidity

- Difficult to exit

- High Maintenance

- Lower Rental Yields

- Limited yearly investment

- 15-Year Lock-in

- Fixed Returns

- Limited Liquidity

- Liquid

- Protects against inflation

- Value Store

- Shields from economic downturns

- Moderate Liquidity

- Stable but Low Returns

- Taxable Returns

- Fixed terms

Conclusion: Equity stands out with highest liquidity and returns over 20 years. Choose wisely for your financial goals.

- Returns Summary

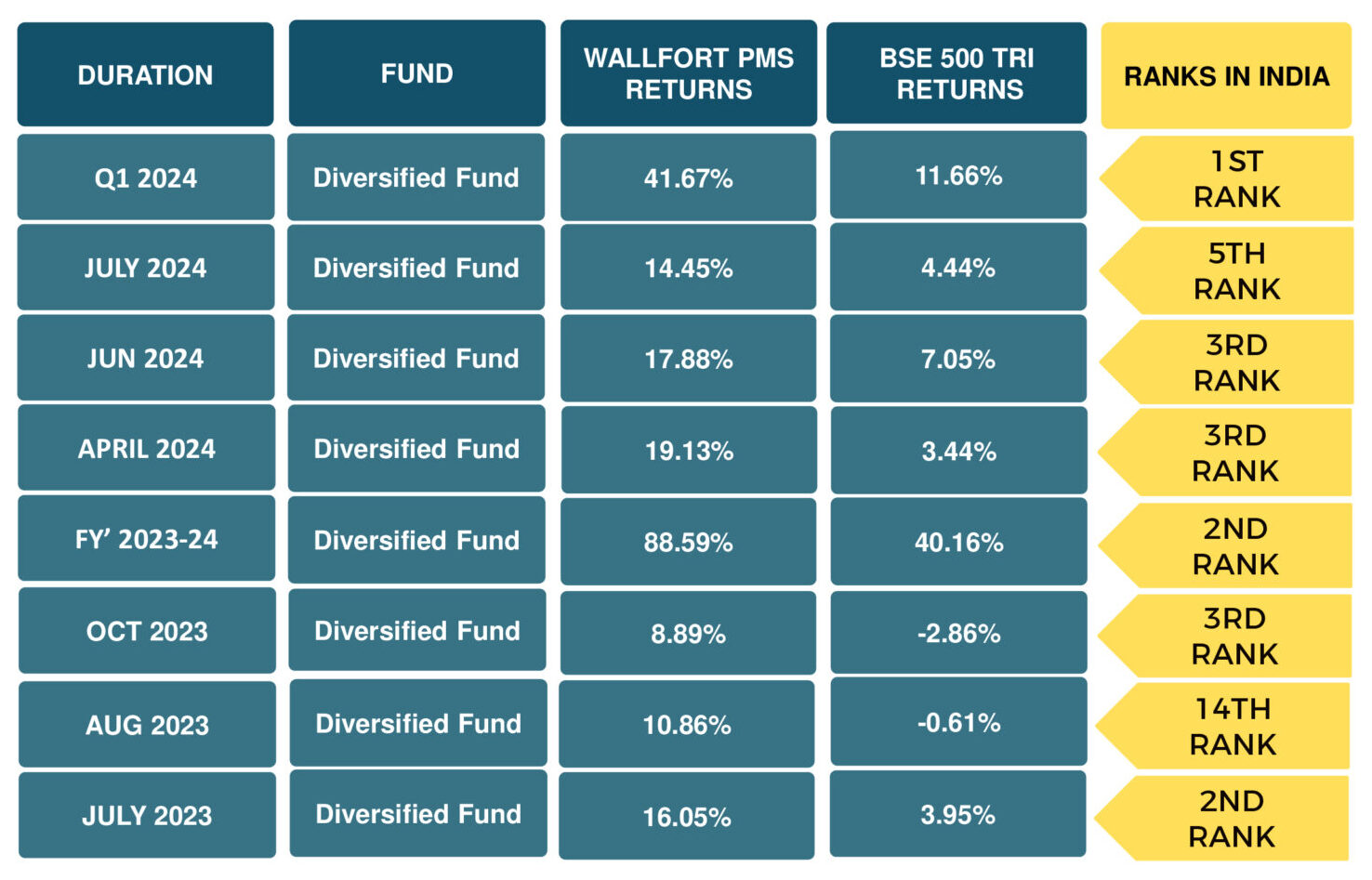

Current Size +400 crores

* Performance audit done by Secmark

* Data fetched from apmi.ai website

* Performance audit done by Secmark

* Data fetched from apmi.ai website

* Performance audit done by Secmark

- Our core team

Mr.Vijay Bharadia

Founder

With a career spanning over two decades in the financial services industry, Mr. Vijay Bharadia is a seasoned professional known for his expertise in investment management and client relations. His journey began in 1997 at Wallfort Financial Services Ltd., where he delved into the intricacies of financial markets under the mentorship of Mr. Manoj Bharadia.

During his tenure in the family office, Mr. Bharadia honed his skills in managing proprietary funds, particularly in navigating the realm of micro-cap investments. His deep understanding of businesses and valuations allowed him to make informed decisions, leading to successful outcomes for the family’s portfolio.

Take right decision at the right time.

- APPROACH

Investment Approach

Low Debt

Companies having low debt levels or are net cash positive

Positive Earnings Growth

We select companies that have positive EPS growth for the last

5 years

Cash Flow

Our portfolio includes companies with strong and consistent cash flow generation

Management

Good dividend paying record,corporate governance practices anda sound long term performance

Capital Allocation

Companies which have good distribution and investment of financial resources

Meeting Regulatory Frameworks &Compliances

Companies which have clean track record

- Strategies

Four P Investment Strategy

At Wallfort PMS, we adhere to the Four P Investment Approach, a disciplined methodology designed to identify high-quality investment opportunities and deliver superior long-term returns. Each “P” represents a critical factor that we meticulously evaluate before making investment decisions.

Promoter Integrity

Product Moat

Profitability Metrics

Price Consideration

By adhering to the Four P Investment Approach, we aim to identify resilient businesses with strong growth prospects, led by trustworthy management teams, and available at attractive valuations. This disciplined approach guides our investment decisions, allowing us to deliver sustainable returns for our clients over the long term.

- PROCESS

Investment / Screening Process

Investment Universe

Small & Mid Cap Companies

Quantitative Screening

Identifying stocks with Secular Growth Thesis (Discount to intrinsic value > 30%): Initial pool of 500 Stocks

Fundamental & Technical Analysis &Qualitative Screening

Conducting a ‘360-degree view’ analysis of each company to identify competitive advantages: Narrowing down to 80-100 Stocks

Fund Portfolio

Selecting high-conviction ideas with superior risk-adjusted return characteristics: Finalizing a portfolio of 15-20 Stocks

Investment Universe

Small & Mid Cap Companies

Quantitative Screening

Identifying stocks with Secular Growth Thesis (Discount to intrinsic value > 30%): Initial pool of 500 Stocks

Fundamental & Technical Analysis &Qualitative Screening

Conducting a ‘360-degree view’ analysis of each company to identify competitive advantages: Narrowing down to 80-100 Stocks

Fund Portfolio

Selecting high-conviction ideas with superior risk-adjusted return characteristics: Finalizing a portfolio of 15-20 Stocks